The Birth of LIC: Once upon a time, back in 1956, the Indian government decided it was time to organize the wild world of insurance. They waved their magic wand (actually, they passed a law) and brought together over 245 private insurance companies and provident societies. The result? The Life Insurance Corporation of India, or LIC for short, was born. This move was like combining all the ingredients in a kitchen to make the perfect insurance recipe. And to top it off, LIC was given a catchy tagline, “Jeevan ke Saath Bhi, Jeevan ke Baad Bhi” (which means “In Life and After Life”), even though nobody can quite remember when exactly that slogan came to life.

How LIC Became Huge: LIC didn’t just sit back and relax after its grand entrance. It got straight to work offering a few key products that Indians quickly fell in love with:

- Whole Life Insurance: This was like a promise to be there forever. Pay some money now, and when the policyholder passes away (hopefully after a long, happy life), their family gets a financial payout.

- Endowment Policies: These plans were a mix of savings and insurance. If you survived the policy term, you got a nice lump sum. If not, your family got it.

- Money-Back Policies: Think of this as getting little bits of money back at regular intervals, plus a big chunk at the end. It was like a savings plan with a bonus.

These products were a revelation for many Indians. Instead of just buying gold or land, they now had another way to secure their future and that of their children. The phrase “My dad left me land and an LIC policy” became common because having an LIC policy was seen as a smart financial move.

The Secret Sauce: LIC Agents: So, how did LIC manage to sell so many policies? The secret was its vast network of agents, who became the lifeblood of the company. These agents were everywhere—cities, towns, villages—you name it. They weren’t just salespeople; they were like financial advisors and family friends rolled into one.

The Agents’ Superpowers:

- Primary Sales Force: These agents were the main folks selling LIC policies. They knew all about the products and could explain them in simple terms.

- Customer Education and Consultation: They didn’t just sell; they educated. Agents explained why life insurance was important, helping people make informed choices.

- Personalized Service: Insurance can be confusing, but LIC agents made it simple. They gave personalized advice, helping customers choose the right plans for their needs.

- Assistance with Policy Purchase: They helped with all the paperwork, making sure everything was filled out correctly and submitted on time.

- Ongoing Customer Support: The relationship didn’t end with the sale. Agents helped with renewals, claims, and any questions that popped up.

Why Agents Were Crucial: LIC’s agents played a massive role in its success. They helped the company reach people in rural and semi-urban areas where other sales channels might not work as well. Their face-to-face interactions built trust, a crucial factor in selling something as important as insurance. Plus, many agents were from the same communities as their clients, speaking the same languages and understanding the local culture. This familiarity made it easier to build relationships and explain the benefits of insurance in a relatable way.

Training and Rewards: LIC didn’t just send its agents out into the world unprepared. It provided comprehensive training on product knowledge, sales techniques, and customer service. Agents were also kept up to date with new developments through regular training sessions. To keep them motivated, LIC offered a commission-based structure, along with rewards and recognition for top performers.

LIC’s Market Share and Current Trends: Fast forward to 2024, and LIC is still the big boss of the Indian insurance world. With a market share of about 58.87%, it’s like the king of the insurance jungle. Even though there’s more competition now, LIC remains a favorite, partly thanks to its agents and partly because of its solid reputation built over decades.

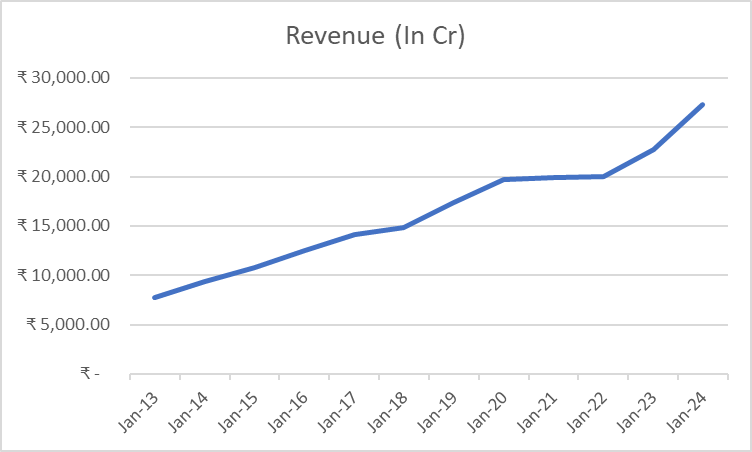

Financial Performance: LIC isn’t just big; it’s also profitable. In the last fiscal year, LIC reported a net profit of approximately ₹40,885 crore. That’s a lot of zeroes! This profit wasn’t just from selling policies; LIC also made smart investments, which boosted its earnings.

Stock Performance: If you think LIC’s profits were impressive, wait till you hear about its stock price. Over the past year, LIC’s shares have shot up by about 69.7%, which is a pretty sweet deal for investors.

Product Innovation and Customer Reach: LIC isn’t resting on its laurels. It continues to innovate, offering new products and expanding its digital presence to attract younger, tech-savvy customers. They’re balancing traditional methods with new technologies to stay ahead of the game.

Current Product Offerings: LIC offers a range of products to suit different needs:

- Term Insurance Plans: These are basic but essential. They offer high coverage at low costs, providing financial security for families.

- Endowment Plans: A mix of savings and insurance, perfect for long-term goals like kids’ education or buying a home.

- Money-Back Plans: These provide liquidity with periodic payouts, plus a lump sum at the end.

- Whole Life Plans: Coverage for life, making sure your loved ones are taken care of, no matter what.

- Pension Plans: These help build a retirement corpus, ensuring a steady income post-retirement.

- Unit-Linked Insurance Plans (ULIPs): A mix of investment and insurance, though they’re a bit more complex and not everyone’s cup of tea. But a big no from me.

- Health Insurance Plans: Covering medical expenses and providing financial assistance for critical illnesses.

LIC’s Assets Under Management (AUM): As of March 31, 2024, LIC had an AUM of around ₹51.2 lakh crore (₹51.2 trillion). That’s a lot of money, folks! It’s the largest in India’s insurance sector, highlighting LIC’s massive influence and financial strength.

The Road Ahead: While LIC remains a giant in the insurance world, it faces challenges. The company needs to continue diversifying its products and finding new growth drivers. It has to adapt to changing market conditions and customer expectations. The good news is, with its rich legacy and strong foundation, LIC is well-positioned to continue being a trusted name in Indian households.

And there you have it, the LIC story—a journey of growth, trust, and a little bit of magic, thanks to its dedicated agents and loyal customers. Here’s to LIC, the pride of India

- A Personal Journey Through 100+ Google Products and Services - December 16, 2024

- Data Mining, Machine Learning, and Big Data: Simplified Insights - November 28, 2024

- Understanding Cryptocurrency: What Does It Mean to Own a Bitcoin? - November 27, 2024