It was the beginning of the year 2000. Eicher Motors, the holding company of Royal Enfield, was having its board meeting. The decision was to completely shut down or sell of the Royal Enfield business – which sold a mere 2000 units a month ago. Cue the music – here enters the hero of our story, a charismatic 26 year old passionate about motorbikes – Siddartha Lal. Let’s deep dive into what happened next.

Chapter 1 : Introducing Our Hero – Siddartha Lal

Siddartha was a third-generation entrepreneur from the Lal family, a major promoter of the Eicher group of companies. He was even seen riding his red bullet to lead the Baraat to his wedding venue instead of a horse – a die-hard bullet fan indeed. The brand is not a favourite only for Siddartha but is an iconic brand synonymous with the tagline – “Made like a Gun”. There truly had to be something different about the brand that made it touch millions of hearts.

“I just saw it, and I fell in love with it. That motorcycle became my real companion.” – Siddhartha Lal.

His father, Vikram Lal, was the earlier chairman of the company and had stepped down in 1997. Come 2000, the reins of the CEO were passed on to his son, Siddartha Lal. An automotive and mechanical engineer by heart, Siddartha was an alum of Cranfield University and the University of Leeds. He set out on a mission to revive the brand he loved so dearly.

Chapter 2 : Mission Revival

Siddartha went to the roots of why India loves Royal Enfield. To look back, It became increasingly popular post World War 2 and was used mainly by the Indian Army. A soldier riding the green macho Bullet is an image we can all relate to. However, their target customers were moving towards newer Japanese brands post-liberalisation, which had modern features and killed the sales of Royal Enfield. This was the situation when Siddartha took over in 2000, and even loyal fans were forced to switch over to brands like Yamaha and Suzuki. The main challenge was maintaining the Royal Enfield image whilst modernising the fleet.

Earlier, the British, Madras Motors and Eicher themselves had tried to revive this brand but failed. So, what was the first thing Siddartha did? He divested 13 of the 15 businesses that Eicher was into, retaining only 2 divisions – Tractors and Royal Enfield, where he saw the most potential. Royal Enfield, which had a capacity of 6000 units a month, was selling just 2000 units a month, leading to a high Degree of Operating Leverage owing to Fixed costs.

Chapter 3 : Living the Life of the Customer

Most management gurus stress the importance of understanding the customer journey and living with the problem. This is exactly what our hero did. He got on his bike and went on a road trip. Not for days, not for weeks, but for months together. Throughout his journey, he interacted with bikers asking them what made them shift to the Japanese competitors. These meaningful conversations helped him understand what the customers like about RE, what made RE what it is, and what would make them shift to RE. The Perfect Market Research?

“Honestly, at age 26, it seemed a fun thing to do. I could eat, sleep, ride, and talk motorcycles” – Siddhartha Lal.

Although his intended destination was Ladakh, he could not reach it due to weather conditions. It had been days since anyone heard from him. He was stuck in a small village near Ladakh and had to be airlifted back to safety. But Siddartha’s mission was completed. An enlightened Siddartha returned with a clear roadmap in his mind. What was the next thing he did? He sent vital employees on the same mission he had just returned from, ensuring their visions aligned. In 2005, Siddartha made Ravichandran as CEO to execute his plans. Ravichandran had diverse experience working at TVS, Suzuki, and Bajaj Auto.

Chapter 4 : Picking the Problems that Mattered the Most

An enlightened Siddartha now had to deal with a huge list of problems and find a solution that was desirable, feasible and viable to the company. The first problem he tackled was fixing the visibility in the value chain. Many bikes were shipped with problems realized only when customers returned with complaints. It was common to see the Bullet bike with an extra backup clutch cable those days.

Secondly, RE shipped bikes on multiple platforms, and the cast iron engine was bulky and violated modern emission norms. He transitioned to a single platform and shifted to using aluminum. Aluminum was much lighter and reduced the weight of an RE engine by up to 20kgs. It also had better heat dissipation and improved damping capacity. The third problem was the infamous kicker. RE bikes had many problems with kickstarts, and it was not uncommon to see people sustaining injuries from the kicker. This led to the introduction of an electric start.

We retained many of the old engine’s characteristics – the long stroke, the single-cylinder, the high capacity with pushrod mechanism – Ravichandran

Chapter 5 : Royal Enfield – A Lifestyle

Sales had started to pick up exponentially, and Siddartha’s strategies were finally yielding fruit. However, it was not enough to just get back on track. Siddartha had understood from his interactions what the customer’s underlying needs were. They aspired to be part of the lifestyle that a RE rider lives. This kickstarted phase 2 of his plan – to transition from an engineering company to an experience provider. This started with a big revamp of RE stores.

Their purpose was no longer only to sell bikes but to sell the Royal Enfield lifestyle. The outlets had the feel of an international cool lifestyle biking brand, selling riding gear, helmets, jackets and biking merchandise. The staff were biking enthusiasts themselves, and the outlets were loud and appealing.

The Enfield Riders community was founded, and events like Motoverse and community meetups were held. This brought together their loyal fanbase and passionate riders without much effort from the company. The community became a thriving platform for riders to discuss, interact and engage on rides. It even provided roadside assistance and helped fix minor bike issues. It wouldn’t be wrong to say Siddartha created a “RE Tribe”.

Wrap Up

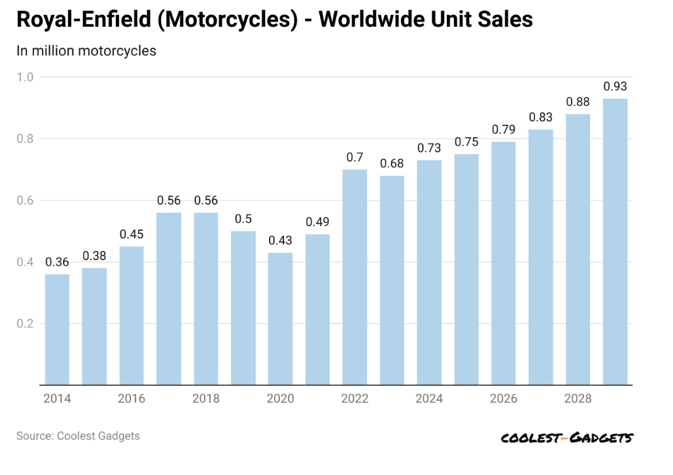

It is said that in 2000 if you invested money in Eicher motors rather than buying an RE bike, it would be worth 7.8 crores now. In the last 25 years, the share price of Eicher Motors has grown by an outstanding 3,90,000%. Yes, you read that right! In FY 2022-23, the company’s Revenue from operations was nearly ₹22,000 crores, with a healthy Profit After Tax of nearly ₹4,000 crores. They touched a record sale of 9,20,000 units in 2023 and currently offer a wide range of models. It exports to over 50 countries.

Nobody would have imagined a 26-year-old would take the world by storm. He preferred to meet his customers and live their journey rather than any form of market research. He was bold, ambitious and motivated – because of his connection to the core business itself. He envisioned the transformation of the company to a lifestyle brand. One can find Royal Enfield cafes and stays in almost all famous biking destinations. At the time of writing this article, Eicher stock had a value of ₹4,735.9 and a market cap of ₹1,29,000 crores. A person who bought an RE bike back then may not have 7.8 crores today, but he has both a gem of a machine and experiences that cannot ever be bought. Even today, the infamous thump-thump of Royal Enfield lives on!

Note – The opinions expressed in this article are solely personal. They have been derived from research based on published news articles and interviews. It is meant to understand the journey of a transformational visionary and not to promote any specific brand. While every effort has been made to ensure accuracy, the views and opinions expressed are those of the author and do not necessarily reflect the official stance of Royal Enfield. You are encouraged to do your own research before drawing conclusions. This article is not written using ChatGPT.

- write for us - November 9, 2024

- BharatMala – India’s Mega Expressway Transforming Connectivity and Driving Growth - November 8, 2024

- Decoding Flipkart’s Big Billion Days Strategy - November 7, 2024